Revenue margin formula

Number of units sold x average price. The Gross Profit Margin shows the income a company has left over after paying off all direct expenses related to manufacturing a product or providing a service.

Techwalla Com How To Calculate Gross Profit Margin Using Excel Techwallacom B07bd92b Resumesample Resumefor Excel Gross Margin Calculator

Is 30 for the year.

. Contribution margin Sales revenue Variable expenses. Or financial ratios like gross margin percentage gross marginrevenue. Revenue for year 2018 100907 Revenue for year 2017 73585 Revenue Formula Example 3.

The margin of Safety when percentage is asked budgeted sales units breakeven sales unitsbudgeted sales units 100. It is determined by subtracting the cost it takes to produce a good from the total revenue that is made. The gross margin equation expresses the percentage of gross profit Percentage Of Gross Profit Gross profit percentage is used by the management investors and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales.

Amount wagered refers to the amount of money collected from gambling andor betting transactions. The profit margin formula is. The formula for gross margin percentage is as follows.

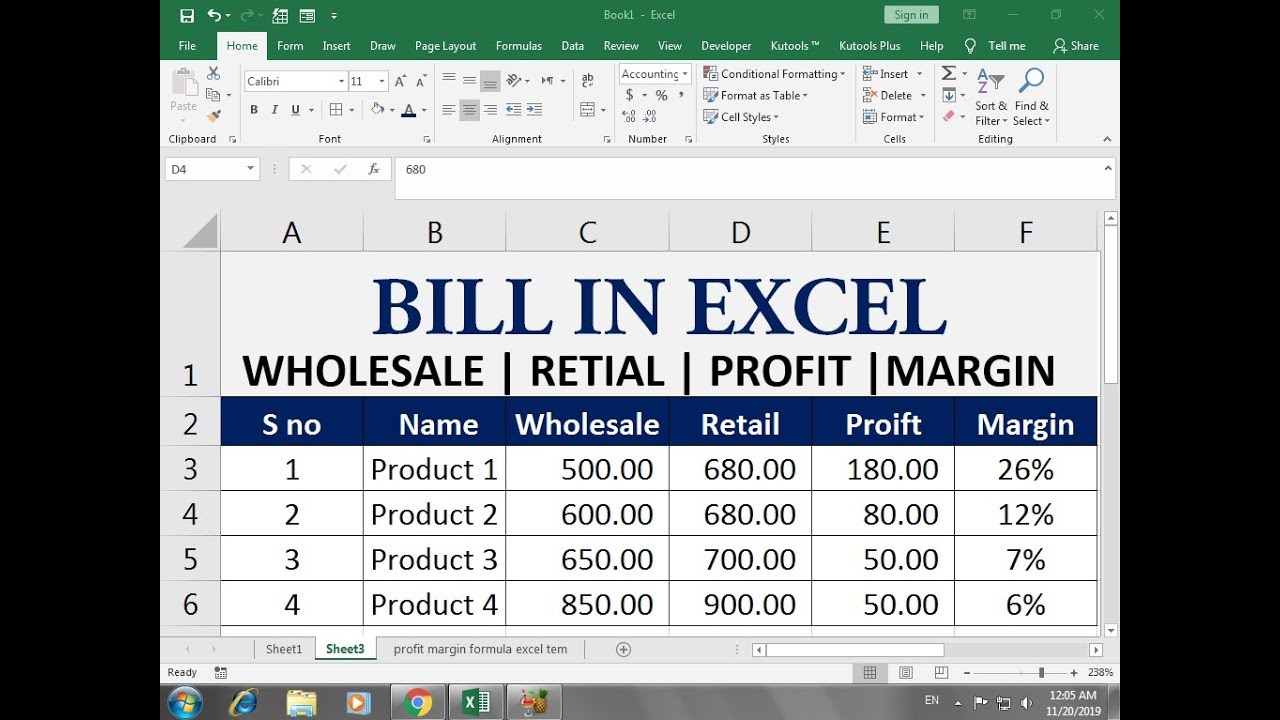

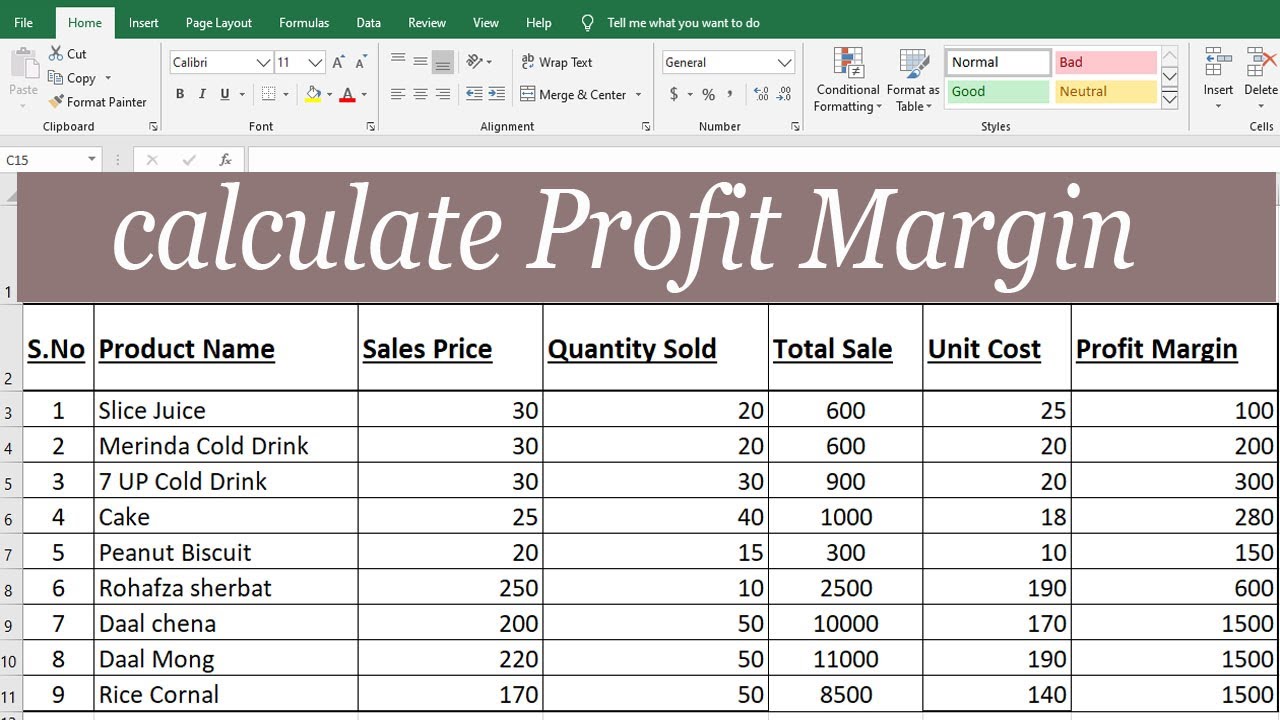

While the total revenue is 100000 subtracting the COGS operating expenses interest and taxes results in a net profit of 30000. Each item in the table has different price and cost so the profit varies across items. Using the net margin formula we divide the 30000 net profit by the 100000 total revenue to obtain our net margin percentage.

Provide AmericanBritish pronunciation kinds of dictionaries plenty of Thesaurus preferred dictionary setting option advanced search function and Wordbook. These formulas are implemented based on the given conditions. The numerator of the formula ie contribution margin can be calculated using simple contribution margin equation or by preparing a contribution margin income statement.

The equation or formula of contribution margin can be written as follows. Using this information and the formula above we can calculate Electronics Company XYZs operating margin by dividing 4000 operating earnings by its 30000 revenue. Production and sales data.

Heres how these three formulas can be implemented. The margin of Safety when total revenue is required margin of safety units selling priceunit. The formula for calculating gross gaming revenue is the following.

The profit equation is. The total sales revenue of Black Stone Crushing Company was 150000 for the last year. The most simple formula for calculating revenue is.

Gross Gaming Revenue Margin. The profit margin formula simply takes the formula for profit and divides it by the revenue. Net profit margin is the ratio of net profits to revenues for a company or business segment.

This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm. Winning payouts refers to the amount of money thats been paid out to customers for winning. This means that for every 1 in sales Electronics Company XYZ makes 013 in operating earnings.

Profit margin is the ratio of profit divided by revenue. The fixed and variable expenses data of the last year is given below. Gross Margin 38.

Alternatively it is known as the contribution to sales ratio or Profit Volume ratio. Then if we divide the 4 million safety margin by the projected revenue the margin of. Gross profit margin shows how efficiently a company is running.

It tells you how much profit each product creates without fixed costs. Formula for Gross Gaming Revenue. Margin 100 revenue - costs revenue.

Using the gross profit margin formula we get. Unit contribution margin per unit denotes the profit potential of a product or activity from the. For example if a company expects revenue of 50 million but only needs 46 million to break even wed subtract the two to arrive at a margin of safety of 4 million.

Revenue 100. Gross Margin Gross Profit Revenue 100. Profit revenue - costs so an alternative margin formula is.

Gross Margin Formula Example 2. The concept can best be explained with the help of an example. A bakery sells 35 cookies packet per day at the price of 20 per pack to increase the sale of cookies owner did analysis and find that if he decreases the price of cookies by 5 his sale will increase by 5 packets of.

For the year ended. Contribution margin ratio 20M 50M 40. It is the percentage of selling price that is turned into profit whereas profit percentage or markup is the percentage of cost price that one gets as profit on top of cost priceWhile selling something one should know what percentage of profit one will get on a particular investment so.

The revenue for each of the five years using the revenue formula should be 60000 110000 160000 210000 and 260000 respectively. Now that you know how to calculate profit margin heres the formula for revenue. Gross_margin 100 profit revenue when expressed as a percentage.

Typically expressed as a percentage net profit margins show how much of each dollar collected by a. This ratio is used to. In other words given a price of 500 and a cost of 400 we want to return a profit margin of 20.

Profit margin is calculated with selling price or revenue taken as base times 100. By simply amending the starting revenue 60000 or changing the fixed amount 50000 used in the revenue projection formula the projections for years 1 through 5 can be quickly recalculated. The Fine Manufacturing Company provides you the following data for the year 2017.

From the above calculation for the gross margin we can say that the gross margin of Honey Chocolate Ltd. The formula to calculate gross margin as a percentage is Gross Margin Total Revenue Cost of Goods SoldTotal Revenue x 100. To interpret this percentage we need to look at other similar companies in the same industry.

Here total sales are equal to total revenue of a company. Input a formula in the final column to calculate the profit margin on the sale. Gross Margin of Colgate.

Sales - Total Expenses Revenue x 100 Gross Profit Margin This margin compares revenue to variable costs. The fixed costs of 10 million are not included in the formula however it is important to make sure the CM dollars are greater than the fixed costs otherwise the company is not profitable. Contribution margin dollars 50M 20M 5M 5M 20 million.

The formula should divide the profit by the amount of the sale or C2A2 100 to produce a percentage. Net profit margin measures the profitability of a company by taking the amount from the gross profit margin and subtracting other operating expenses. The general formula where x is profit margin is.

We can represent contribution margin in percentage as well.

Cost Of Goods Sold Formula Calculator Excel Template Cost Of Goods Sold Cost Of Goods Excel Templates

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

Average Restaurant Profit Margin And Restaurant Operating Expenses Brandongaille Com Restaurant Management Restaurant Marketing Restaurant Names

Distribution Channel Margin Calculator For A Startup Plan Projections Start Up Channel Business Planning

Pin On Airbnb

Profit Or Loss Startup Business Plan Gross Margin Start Up Business

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation

Margin Vs Markup Chart How To Calculate Margin And Markup Accounting Bookkeeping Business Business Analysis

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Accounting And Finance Finance Investing

Calculate Profit Margin With Percentage In Excel By Learning Center In U Excel Tutorials Learning Centers Excel

Operating Leverage A Cost Accounting Formula Cost Accounting Increase Revenue Business Risk

Break Even Sales Formula Calculator Examples With Excel Template Excel Templates Formula Sales And Marketing

Contribution Margin And Break Even Points Managerial Accounting Tutorial 13 Cost Accounting Contribution Margin Accounting Notes

The Difference Between Gross Profit Margin And Net Profit Margin Net Profit Profit Company Financials

Projected Profit And Loss Account In Excel Format Profit And Loss Statement Statement Template Spreadsheet Template